1702q deadline 2023|Tax Calendar : Baguio May - Tax Calendar - Bureau of Internal Revenue VISMAT VRAY FOR SKETCHUP » Concrete Vismat Concrete Vismat vray for sketchup pack 1 00044 ONLY FOR CLUB MEMBERS FREE. VISMAT VRAY FOR SKETCHUP » Bricks Vismat Bricks vray for sketchup Vismats Pack 1 - 00043 FREE. CUT OUT » Vegetation » Trees CUT OUT TREES PACK 6 00041 FREE. MIXED .

PH0 · eFPS Option Page for Form 1702Q

PH1 · When to File : A List of BIR Tax Deadlines

PH2 · Tax Calendar

PH3 · Income Tax Return

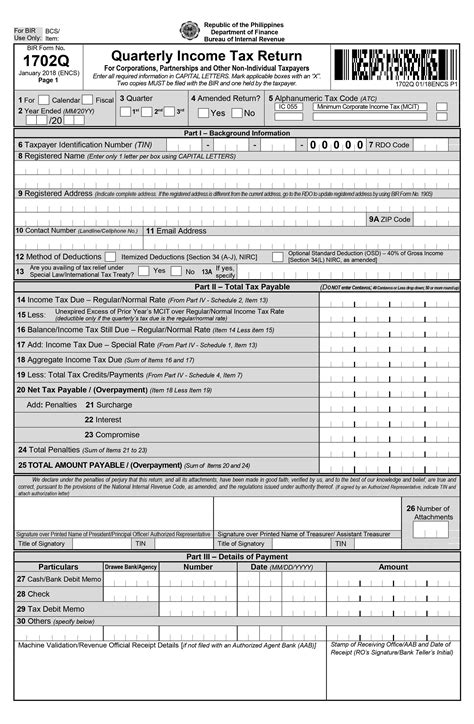

PH4 · Generating BIR Form 1702

PH5 · Form 1702Q

PH6 · BIR Tax Deadlines

PH7 · BIR Tax Deadline

PH8 · BIR Form No. 1702Q

PH9 · April

711 - TONEEJAY (G - Em - D)😍| EASY GUITAR TUTORIALWazzup Guyss 😍 Basic Guitar Tutorial tayo sa kantang "711 by TONEEJAY" eto na guys yung Super Easy Versio.

1702q deadline 2023*******BIR Form 1702Q (Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual Taxpayers) and Summary Alphalist of Withholding Taxes (SAWT) Fiscal Quarter ending October 31, 2023 e-SUBMISSION2023 BIR Rulings; 2022 BIR Rulings; 2021 BIR Rulings; 2020 BIR Rulings; 2019 .

May - Tax Calendar - Bureau of Internal RevenueBIR Form 1702Q (Quarterly Income Tax Return For Corporations, Partnerships .July - Tax Calendar - Bureau of Internal Revenue

1702q deadline 2023June - Tax Calendar - Bureau of Internal Revenue

Find out the forms, deadlines, and requirements for filing your income tax return in the Philippines. BIR Form No. 1702Q is for quarterly income tax return of individuals and .

The general professional partnership is not required to file quarterly income tax return/quarterly information return. It is required, however, to file annual income tax .

This Tax Calendar has been prepared by the Tax-Client Accounting Services (CAS) group of Isla Lipana & Co., the Philippine member firm of the PwC network, based on relevant . BIR Form 1702Q (Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual Taxpayers) and Summary Alphalist of .Learn how to file BIR form 1702Q, a tax return for corporations, partnerships and non-individual taxpayers in the Philippines. The deadline for submission is on or before the 60th day following the close of each . The Bureau of Internal Revenue Philippines announced the e-filing and e-payment deadline for BIR Form 1702Q and SAWT for the quarter ending September 30, .

eFPS Option Page for Form 1702Q. There are two methods in completing a tax form for submission in the eFPS: The On-Line Method allows you to input your tax information .BIR Form 1702-Q is a tax form used by non-individual taxpayers in the Philippines to file their quarterly income tax returns. The form contains sections that require corporations .1702Q - On or before the 60th day following the close of each of the quarters of the taxable year. Remittance Forms 0619-E and 0619-F - shall be filed every 10th day of the .

Month of November 2023: BIR Form 1606 – (Withholding Tax Remittance Return for Onerous Transfer of Real Property Other Than Capital Asset Including Taxable and Exempt) . BIR Form 1702Q (Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual Taxpayers) and Summary Alphalist of Withholding Taxes .Annual Income Tax Return (for self-employed individuals) April 15. 1701-Q. Quarterly Income Tax Return (for self-employed individuals) - 1st Quarter. May 15 or 45 days after end of each quarter. - 2nd Quarter. August 15 or 45 days after end of each quarter.

Month of July 2023 . 16 Wednesday. SUBMISSION. Consolidated Return of All Transactions based on the Reconciled Data of Stockbrokers. August 1-15, 2023 . BIR Form 1702Q (Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual Taxpayers) and Summary Alphalist of Withholding Taxes (SAWT)JANUARY 2024. 1 Monday. SUBMISSION. Consolidated Return of All Transactions based on the Reconciled Data of Stockbrokers. December 16–31, 2023. Engagement Letters and Renewals or Subsequent Agreements for Financial Audit by Independent CPAs. Fiscal Year beginning March 1, 2024.

Annual Income Tax Return (for self-employed individuals) April 15. 1701-Q. Quarterly Income Tax Return (for self-employed individuals) - 1st Quarter. May 15 or 45 days after end of each quarter. - 2nd Quarter. August 15 or 45 days after end of each quarter.Filing with the SEC of AFS for YE 31 March 2023 by corporations whose securities are not registered under the SRC/RSA. e-Filing and e-Payment/Filing and payment of 1702Q (ITR) for QE 31 May 2023. e-Filing and e-Payment/Filing and payment of 1601-EQ, 1601-FQ, 1602Q and 1603Q (EWT, FWT and FBT) for QE 30 June 2023. Submission of RFC for .

DEADLINE OF SUBMISSION : Certificate of Compensation Payment / Tax Withheld (BIR Form No. 2316) Calendar Year 2023 : e-FILING/FILING & e-PAYMENT/PAYMENT : BIR Form 1702Q (Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual Taxpayers) and Summary Alphalist of Withholding Taxes (SAWT) Fiscal .

BIR Form 1601-C (Monthly Remittance Return of Income Taxes Withheld on Compensation), 0619-E (Monthly Remittance Form of Creditable Income Taxes Withheld-Expanded) and 0619-F (Monthly Remittance Form of Final Income Taxes Withheld) - eFPS Filers under Group A. Month of October 2023. BIR Form 1702 – RT/EX/MX. Fiscal Year . The deadline for filing this form is the 15th of the second month after the close of the quarter (ex. For Q1 which ends on March 31, the deadline of filing is on May 15). On the other hand, corporations, partnerships, and other non-individual taxpayers are required to file BIR Form 1702Q, which is also a quarterly income tax return.

SO, for the quarter ending September 30, 2019, the deadline will be on the 29th of November 2019. Substantiate your form with the proper documents It is advisable to compile all your receipts and invoices “chronologically” to summarize the income/expense related accounts easily.

Fiscal Year ending February 29, 2024. e-FILING & e-PAYMENT. BIR Forms 1601-C (Monthly Remittance Return of Income Taxes Withheld on Compensation) and/or 0619-E (Monthly Remittance Form of Creditable Income Taxes Withheld-Expanded) and/or 0619-F (Monthly Remittance Form of Final Income Taxes Withheld) - eFPS Filers under Group .Fill-up the BIR Form No. 1702Q in triplicate copies. Proceed to the Revenue District Office where you are registered or to any Tax Filing Center established by the BIR and present the duly accomplished BIR Form 1702Q, together with the required attachments. Receive your copy of the duly stamped and validated form from the RDO. Deadline1702q deadline 2023 Tax Calendar e-Filing and e-Payment/Filing and payment of 1702Q (ITR) for QE 31 October 2023.. Submission of attachments to the 1702 (ITR), together with 1709 (RPT Form), if applicable, for YE 31 August 2023 (e-filers).. Submission of RFC for YE 31 August 2023.. Submission of the SAWT for QE 31 October 2023.. Submission of soft copy of . Meanwhile, for PEZA and BoI-registered business enterprises, the submission of the duly filed ITR and Audited Financial Statements (AFS) is due on May 17, 2023. For companies with a fiscal year end other than Dec. 31, the deadline for filing the annual ITR is on the 15th day of the fourth month following the close of the fiscal year.Philippine Tax Calendar: Tax Deadlines and Reportorial Requirements from Different Philippine Agencies for 2024. The Bureau of Internal Revenue (BIR) annually releases deadlines for tax reporting, submission, filings, and reportorial requirements from Philippine government agencies for individual and corporate taxpayers in the Philippines.Tax Calendar Bureau of Internal Revenue Philippines. January 30, 2023: BIR Form No. 1604-C: Annual Information Return of Income Taxes Withheld on Compensation, with the Annual Alphalist of Employees; January 31, 2023: . DEADLINE: Annual Export Performance Report of Foreign Export Enterprises; May 30, 2023 . PHILIPPINE LABOR LAW REQUIREMENT FOR ALL BUSINESS WITH .

BIR Form 1701Q must be filed every first to third quarter of each year. Below is a guide if you follow calendar year accounting period: First Quarter covering January to March is due on or before May 15. Second Quarter covering April to June is due on or before August 15. Third Quarter covering July to September is due on or before November 15.

There has been a movement to ban the fighting of roosters in Mexico. But for many involved, it is part of the country's national identity and a source of emp.

1702q deadline 2023|Tax Calendar